Current trend

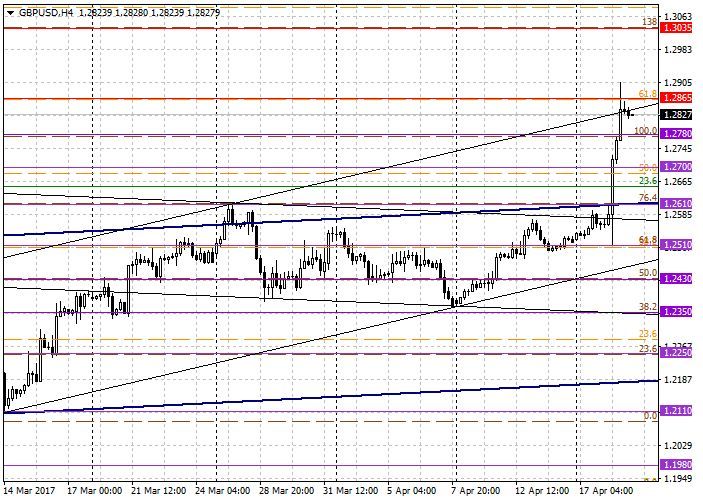

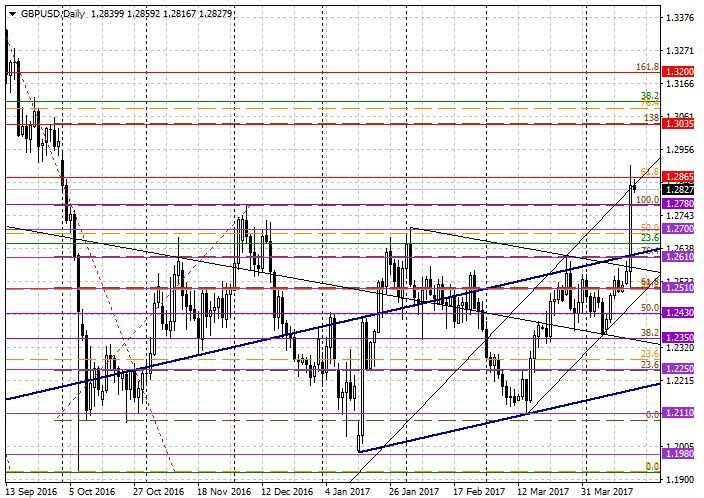

Yesterday’s speech of the UK Prime Minister Theresa May and her statement about early elections viewed by the investors as a positive factor for GBP, as well as the fall of US dollar in view of negative data on the volumes of new housing construction in the USA led to the growth of the pair by almost 400 points. GBP/USD reached the level of 1.2900 that it failed to approach for over seven months and broke through local maximums 1.2700 and 1.2780 and upper borders of D1 (blue an black) channels. Breaking through such strong zones indicates they were supported by stop orders of GBP sellers with considerable volumes. Therefore the scenario with negative influence of Brexit on the pound appeared to be beneficial for few pound buyers.

No important releases from the UK are due today. From the USA the market is waiting for FOMC Beige Book review of the US economy at 20:00 (GMT+2).

Support and resistance

The correction of the pair is the most likely scenario for today.

Resistance levels: 1.2865, 1.3035, 1.3200.

Support levels: 1.2610, 1.2700, 1.2780.

Trading tips

Short positions may be opened at the market price with targets at 1.2780, 1.2700 and stop-loss at 1.2865.

Alternatively buy positions may be opened from the level of 1.2865 with targets at 1.3035 and stop-loss at 1.2770.