Is it time to be bullish the dollar. One thing is for sure….The dollar is now at a HUGE support level that could decide longer-term trend.

USDX

The 98.80-99 level is very important support. A strong upward reversal at least towards 100.80 could start from current levels.

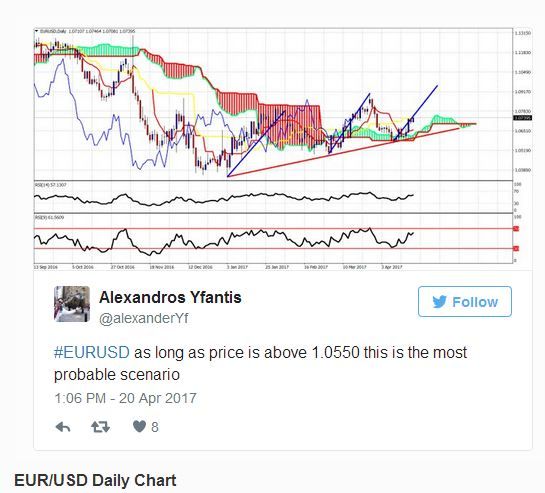

As I pointed out a few days back, as long as we trade above 1.0550 the move towards 1.09-1.10 is the most probable one.

Is it time now to sell EUR/USD? Maybe…but the risk reward favors bearish positions at least for the short-term.

Is it time now to sell EUR/USD? Maybe…but the risk reward favors bearish positions at least for the short-term.

USD/JPY Price has broken the downward sloping trend line. I could see the price back test the broken trend line and then bounce back up towards the cloud resistance near 112-113.

Price has broken the downward sloping trend line. I could see the price back test the broken trend line and then bounce back up towards the cloud resistance near 112-113.

USD/CAD

5 waves up, bearish divergence at the last highs, a pull back towards 1.33 is expected before more downside.

GBP/USD

Supported at 1.2770-1.2750. As long as it trades above it, we could see 1.30.

NZD/USD

Resistance at 0.7050 did not break despite bouncing as expected. Bulls need to show more strength signs for the pair to move towards 0.71 and higher. 0.69 remains key support

Bounce off support as expected but with metals getting hit today, more downside should be expected once we break below 0.7480. 0.7610 is important short-term resistance. Bulls need to break it otherwise the chances are in favor of the bearish camp.

Disclosure: None of the information or opinions expressed in this blog constitutes asolicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.