Forex Learning Site Bangladesh-Current trend

After the strengthening of Canadian dollar against USD last week leading to the weakening of the pair to it 1.5- months minimum (below the level of 1.3000), yesterday the pair started correction after the publication of the data on the return rate of US treasury bills that was the highest in five years and the volume of purchases of long-term US securities that was much higher than expected and updated its 1.5-years maximum. In view of FOMC statements about the reduction of its balance these data are extremely important for the strengthening of US dollar.

No important releases from Canada are due today and tomorrow. From the USA the market is waiting for information on the number of new construction permits at 14:30 (GMT+2) and the volume of industrial output at 15:15 (GMT+2). Both indicators have positive outlooks.

Support and resistance

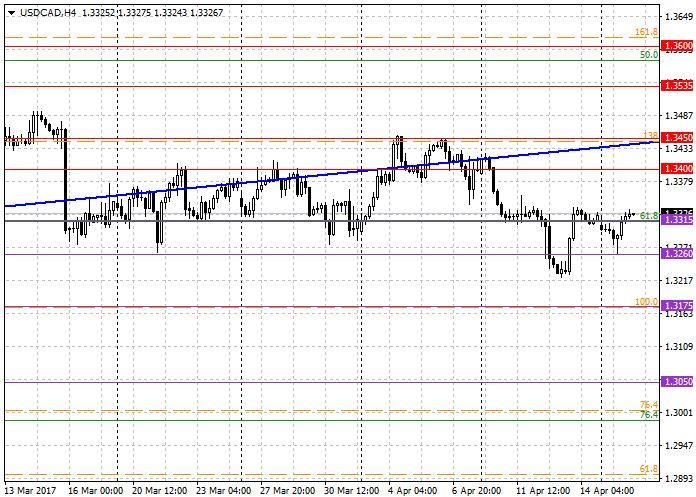

The most likely variant in this situation is correction that may reach the pair’s trend line (lower border of D1 blue channel).

Support levels: 1.3315, 1.3260, 1.3175.

Resistance levels: 1.3400, 1.3450, 1.3535, 1.3600.

Trading tips

Long positions may be opened at the market price with targets at 1.3400, 1.3450 and stop-loss at 1.3290.

Alternatively sell positions may be opened from the level of 1.3400 with targets at 1.3315, 1.3260 and stop-loss at 1.3450.